Developing an enterprise-centric fund for diverse-led Social Purpose Organisations

Growth Impact Fund's enterprise-centric approach revolutionises social investment for diverse founders. Discover our five-pillar blueprint addressing origination, support, decision-making, financial products, and infrastructure to create truly inclusive investment for Social Purpose Organisations.

By Rhea Fofana, Portfolio Manager

As a portfolio manager, I often get feedback from founders about their experiences in accessing investment across the sector. These reflections come unprompted; at panels, social entrepreneur gatherings, in meetings. The passing comments I am privy to are just the tip of the iceberg of examples of how the investment sector was not designed with ALL social entrepreneurs in mind.

“the process for another fund I applied to was unclear, I didn’t know what they expected from me”

“I got to an all-male investment committee and they didn’t understand the market need for a female safety tech product”

“I feel like I don’t know where the doors even are for investors, let alone which doors to knock on”

“I’ve never considered social investment for my business because no one has explained it without jargon before”

Experiences like these are a symptom of something systemic in social investment and investment more widely: funds are designed based on the blueprints of previous funds. Blueprints which are based on ways of investing that led to stats like 0.02% of venture capital investment going to Black female founders between 2009 and 2019. These fund blueprints limit the flow of capital to capable founders who could shape our future for a more equitable and just society if they’re able to access the right finance to get there.

For the Growth Impact Fund, we tore up the blueprints and redrew them alongside entrepreneurs to create an enterprise-centric fund. This blog outlines how we did that and our approach to ensuring the fund remains enterprise-centric, a term we have defined as “putting the needs and aspirations of diverse-founders at the heart of each decision we are making for the fund.”

As Bell Hooks once said, “what we do is more important than what we say or believe”. So what are we doing already?

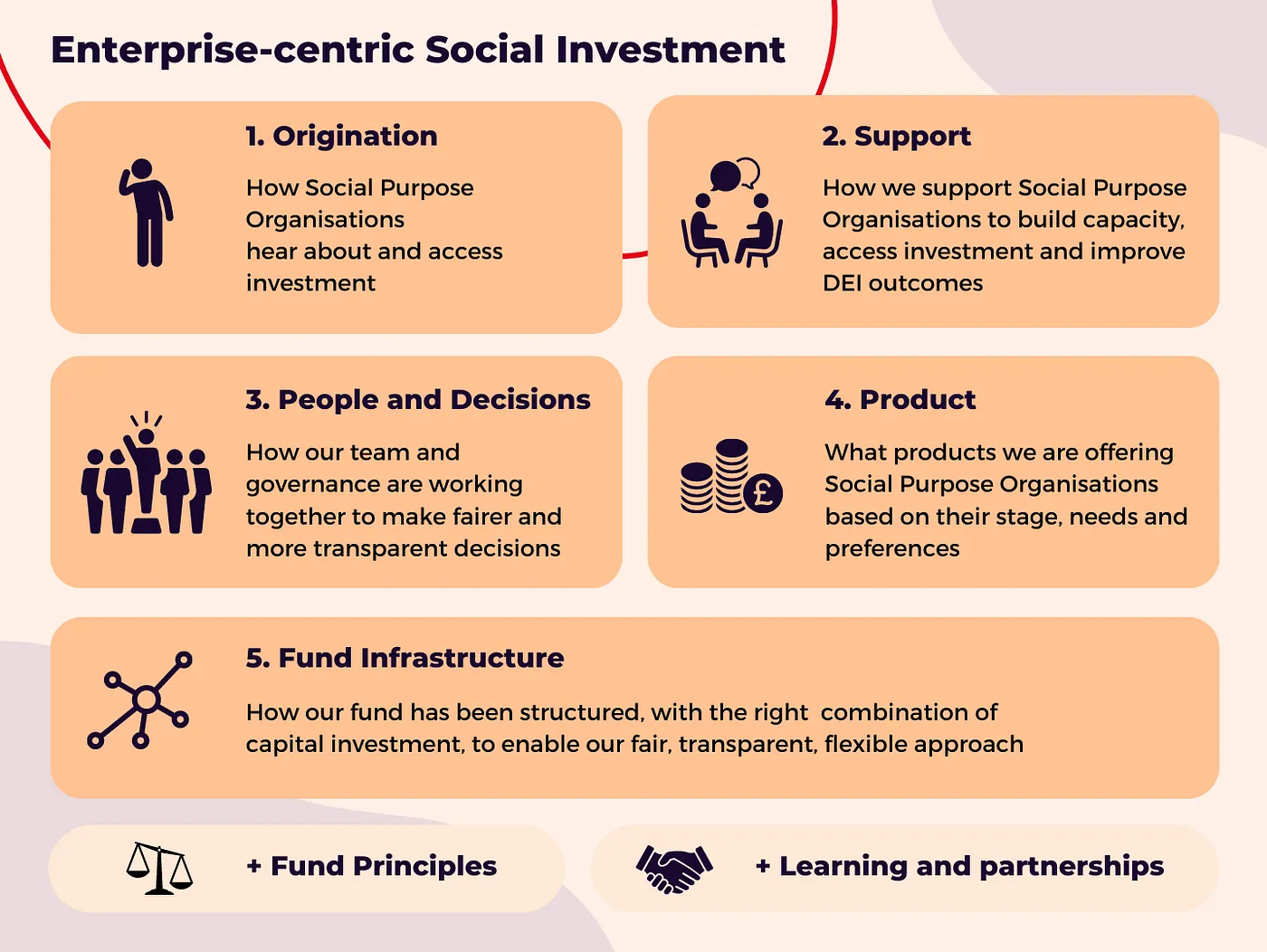

Our blueprint for an enterprise-centric fund for diverse founders

When creating the fund, we knew that social entrepreneurs needed to be at the centre of our approach. To remain committed to impact and inclusion, we developed an Impact Advisory Committee and are guided by the fund’s principles which help us define how we want to be different. We also know we won’t get it right the first time, or on our own, so partnerships and learning are core elements of the blueprint.

As part of our work on the Growth Impact Fund, we have focused on the following 5 elements when designing the fund to build enterprise centricity: Origination; support; people and decision-making; financial product; fund infrastructure.

1. Origination

The Growth Impact Fund’s brand, investment process and outreach partnerships have been designed to ensure our approach to origination is inclusive, accessible and responsive to need.

For us this also includes developing a strong relationship between the investment team and Social Purpose Organisations. We are building in regular engagement and feedback loops with founders and partners to help get this right, including at the design stage.

For example, we’ve recently been testing our website with a number of potential fund applicants for feedback, alongside Scope, a partner in the fund, who have helped us implement additional accessibility measures.

2. Support

The fund is embedding support throughout the investment process to build confidence, trust, and to contextualise investment in the wider aims of the Social Purpose Organisation, whilst also de-risking the investment for the fund by addressing support needs.

This includes offers such as: a pre-investment support plan with a grant option which can cover business support as well as personal support for specific needs such as translation or child-care, ad-hoc tailored support during due diligence and ongoing post-investment support.

This wrap-around support throughout an organisation’s investment journey is a unique offering from the Growth Impact Fund, especially the grant budget for personal costs that responds to the barriers shared by social entrepreneurs during our research such as the cost of child-care.

3. People and decision-making

The people shaping, operationalising and making decisions on this fund, and how they work together (enabled by the fund’s design and structures) will ultimately determine its success and impact.

This means that our fund team is committed to: recruiting a strong and diverse investment team, establishing an investment committee (currently consisting of all women) that will balance financial and social impact in its decisions, and constitute a diverse Impact Advisory Group who will be the guardians of the fund’s impact and diversity, equity and inclusion commitments.

We recognise that this will be an ongoing process of development and learning, and that more needs to be done to ensure that those supporting the fund are representative of the people the fund will be supporting.

For all those involved, there will be learning and development opportunities to test and learn, striving always for decision making that is more inclusive, transparent and equitable. This will include re-assessing the way we conduct diligence to more appropriately take into account the realities for diverse-led social purpose organisations.

The fund will also be managed as a Joint Venture across organisations with different strengths and experiences to maximise the potential of the team.

4. Financial product

The Growth Impact Fund has developed a multi-product offer for organisations of different stages of development, legal types, and investment preferences based on their own goals.

The fund aims to build confidence in the sector around which types of patient, flexible funding products best support different segments of diverse-led businesses including equity, revenue share agreements, and patient debt. We’ll look to adapt our product offering on a case-by-case basis and explore new product iterations as the fund progresses.

5. Fund infrastructure

Our approach to enterprise-centric social investment is underpinned by the structure of the fund. Our fund is an evergreen structure, which means we don’t have to demand returns within a specified timeframe, giving more time and flexibility for entrepreneurs to grow at their own pace.

We’ve also received different forms of capital investment, including grant subsidy, which allows us to take more risks within our portfolio, supporting earlier stage organisations. We hope that this enables the provision of more patient, flexible, and inclusive capital throughout the funds lifecycle.

Partnerships and learning

In addition to designing the fund around these 5 elements, we believe that how they are delivered will be critical to their success. This means that we are placing an emphasis on partnerships — how we collaborate with and beyond the sector, and learning and impact measurement — how we routinely gather data to improve and innovate.

Get involved

If you would like to learn more about the blueprint for the Growth Impact Fund or partner with or support us, get in touch with a member of the team enquiriesGIF@bigissueinvest.com. You can find out more about our continuous learning here.