We invest

from £200,000

to £1.5 million

in organisations led by people with lived experience

We provide three investment options and a grant for you to become investment-ready.

"We prioritised pitching to funders with the same values and commitment to driving social change that we have. Throughout the entire investment process, it was clear that Growth Impact Fund were the perfect fit for Sociability and we were thrilled to have them lead our seed round and, more broadly, back our mission to make the world a more inclusive and accessible place for all"

Matt Pierri

Founder & CEO

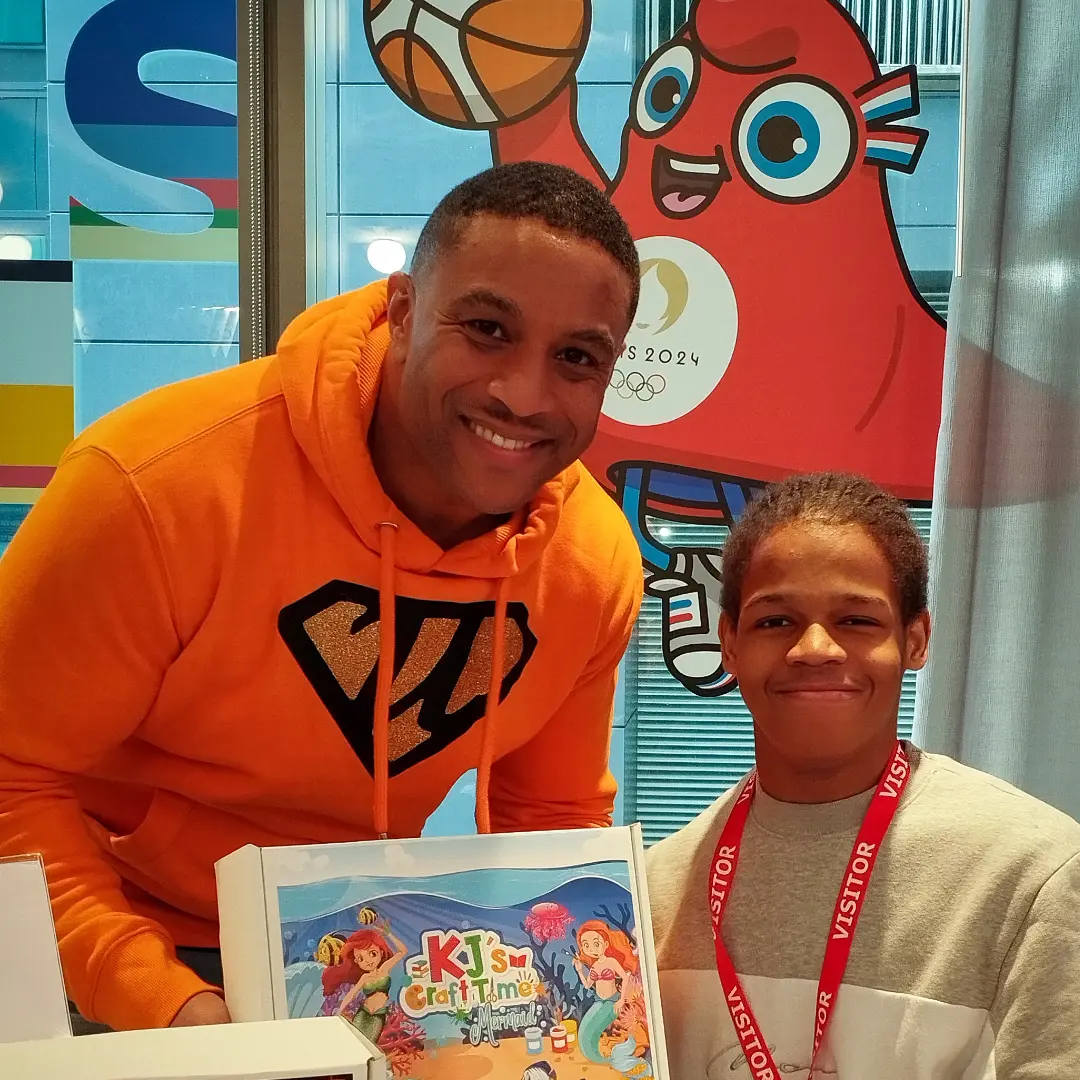

"What stood out to me about the Growth Impact Fund was that they weren't just offering capital—they were offering partnership, values, and a shared vision. They understood that success isn’t just financial—it’s social, it’s cultural, and it’s generational. The fund is geared toward purpose-driven businesses, and that alignment made all the difference."

Wilfred Emmanuel-Jones

Founder

"With the Growth Impact Fund's investment, we've been able to expand our entrepreneurship programs to 50 additional schools in underserved areas, reaching thousands more young people with the tools to create their own opportunities."

Julian Hall

Founder

Support to prepare you and your business to access and activate investment

We're a social impact fund that invests in organisations led by people with lived experience. We provide three investment options and a grant for you to become investment-ready. We are here to support you and your business to access and activate investment.

Investment options for every stage of your journey

We offer a range of investment options to suit your needs, whether you're just starting out or looking to scale your business. Our flexible plans are designed to help you achieve your goals and maximise your potential.

Equity (Paused until 2026)

From £200,000 to

£500,000

We invest in your business in exchange for a share of ownership in the company. This could be right for you if you're looking for exponential growth and a long-term partner.

- Unrestricted funding

- Dedicated support

- Flexible terms

- Diversity, Equity and Inclusion

Revenue

From £200,000 to

£750,000

A loan that is repaid as a percentage of your revenue. This means that if your revenue goes up, so do the repayments, but if it goes down, so do the repayments.

- Unrestricted funding

- Dedicated support

- Flexible terms

- Diversity, Equity and Inclusion

Debt

From £500,000 to

£1,500,000

A loan that must be repaid over time, usually with interest. You keep full ownership, but take on financial risk if you're unable to make the agreed repayments.

- Unrestricted funding

- Dedicated support

- Flexible terms

- Diversity, Equity and Inclusion

Our investees

We've invested in tackling inequity across the country on issues such as employment, accessibility and education. 100% of our founders are from underrepresented groups.

Meet our investees

Our change

Last year alone, the organisations Growth Impact Fund supports reached 65,000 people facing inequalities in the UK

View our impact report